Buying property abroad is a tricky business, especially when it comes to buying outside the euro zone. You have to pick an area, choose a property type, sort out all legal issues and finally risk a large sum of money in a currency you might never even have heard of. | | Hedging against currency risk |

Any potential profit made on an overseas property investment can easily be wiped out by an adverse currency movement.

As we all know, the US dollar has weakened by more than 40 per cent against the euro over the past three years. If you had purchased a property in Florida, for example, it would need to have appreciated in value by at least 40 per cent before you would only break-even on your investment!

Why take the risk of running a currency exposure when you are already secretly praying that your property will appreciate in value? Can anything be done to avoid that extra risk?

By hedging your currency exposure, you actually benefit in full from the capital appreciation of your property, regardless of what happens on the foreign exchange markets.

How does it work?

ShareSpread allow you to take a leveraged position on currency futures in order to fully hedge a currency exposure on a foreign property investment through the use of spread trading.

Don’t let the terminology put you off! It is actually very simple and extremely cost effective. The best way to explain it is with an example.

Example: August 2005. As a practical example, say you have a budget of €100,000 to buy a house in Florida and you are a euro-based investor.

You would want to BUY USD against EUR at the bank to cover your purchase, and SELL USD against EUR, to cover your currency exposure for say the next six months.

The EUR/USD exchange rate at the time of purchase is 1.3220 and you have a time horizon of six months.

You go to your bank and, taking into account fees and commissions, get more or less $130,000 to go and buy your house in Florida.

At the same time, you would get a quote for a EUR/USD six-month exchange rate at say 1.3215 – 1.3225, meaning you could buy EUR/USD at six months at a level of 1.3225.

A trade of €10 euros a point indeed corresponds to your investment of €100,000 as currencies are quoted in 10,000th

That means that if the EUR/USD exchange rate moves up from 1.3225 to 1.3235 and you have bought for €10, you make €100.

February 2006. Six months later you are happy to sell your house in Florida as it is now worth about $165,000, an excellent capital appreciation.

But the exchange rate between euros and dollars has moved, and you have to take that into account to calculate your actual return.

Had you not hedged the currency exposure, any move UP in the euro versus the dollar would have been detrimental to your overall return, any move DOWN would have been beneficial.

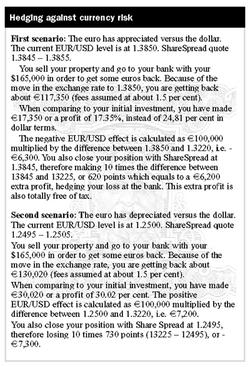

As a shrewd property investor, you have decided to hedge your currency exposure. Scenarios one and two show us the two possible outcomes.

As you can see, in both cases the extra profit or loss generated by your currency hedging trade with ShareSpread is an almost perfect hedge for your currency exposure with your bank.

Without hedging, the outcome would have been unknown. Your profit could have been higher or lower, or possibly even totally wiped out by the currency movements.

The recent volatility in currency markets has proved particularly difficult to handle for private investors. Is it worth taking the extra risk? Would you have been happy with your original 25 per cent appreciation on your property? Would it not be worth always hedging?

There are no commissions, no capital gains taxes or stamp duty to be paid. ShareSpread can eliminate your exposure to sterling, the US dollar, the South African rand or any of the other liquid currencies to which you may be exposed. |